Thai Citizen / Permanent Resident (PR)

Habitual resident with ongoing Thai assets/family.

Recommendation: Yes — Thai will (often the primary instrument), coordinated with any foreign will.

In case of a resale condo unit/ apartment in Thailand the purchase price for the unit could be paid by cashier's check to the seller at the time of transfer of ownership of the unit at the land office. In this case the buyer of the condo must obtain a cashier's cheque and the foreign exchange documents (FET form) from his bank inside Thailand required for registration of foreign ownership under condominium laws.

Off plan or pre-construction or under construction real estate developments in Thailand are usually financed by the buyers who pay deposits and price installments during the construction directly to the developer who uses these payments to finance the housing or apartment project. In the event of default or bankruptcy of the developer the buyers could lose all monies paid unless his payments were deposited in an escrow account held by a third party

'Matrimonial law' in Thailand is primarily codified in the Civil and Commercial Code. The legal system of Family Law in Thailand is based on mainland Europe Civil Law with main influences from the French 'Code Civil'.

To qualify for foreign ownership under the Thailand Condominium Act a foreign purchaser of a condo unit is required to remit the full purchase price for the condo in foreign currency into Thailand, unless he is a resident in Thailand or eligible for foreign ownership under one of the other less common grounds of section 19 of the Condominium Act.

Thailand restricts and prohibits economical areas and business categories for foreigners primarily in the Foreign Business Act (A.D.1999). Under the Foreign Business Act (FBA) foreigners are prohibited from engaging in most business categories in Thailand, unless an alien business operation permit has been obtained from the Director-General of the Department of Commercial Registration with the approval of the Foreign Business Committee. Separate laws control foreign ownership of land as well as such activities as banking, insurance, finance and shipping.

Foreigners cannot own land in Thailand but are allowed to lease land under a land lease agreement registered with the land department and own the structure built on leased land. Obtaining the correct legal ownership of the building greatly increases the land lessee's rights and long term interest in the property. The right to own a building upon another man's land however always relates to the right to use and possess the land, i.e the term of the land lease (and optional the term of an additional right of superficies).

Foreigners cannot own land and house as under Thai land laws foreigners are prohibited from owning land in Thailand. Foreigners can however obtain outright ownership of an apartment unit in a licensed condominium building. The condominium act (section 19) governs foreign ownership.

Read more: Foreign ownership of an apartment unit in Thailand

Foreigners can own an apartment in a condominium in Thailand, but ownership of land or land and house is limited to only Thai nationals. It is under the Thailand Land Code Act not possible for foreigners to obtain outright ownership over land and house in Thailand. Foreign land ownership limitations apply but many foreign investors have been duped into believing that they can own land in their own name in Thailand.

Read more: Foreign real estate investment options in Thailand

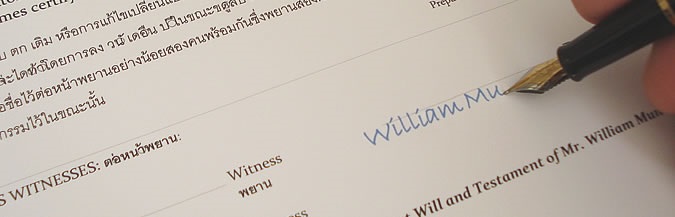

Planning your last will and testament in Thailand ensures your assets are distributed according to your wishes. Without a valid will, Thai inheritance law (or sometimes foreign law) may decide who inherits, and the result might not reflect your intentions.

Wondering if you need a Thai will? Start with your A/B/C profile and then check by asset type (condo, lease, bank, shares). A Thai will usually streamlines administration, but it still goes through Thai court probate.

This is general information, not legal advice.

Inheritance in Thailand is governed by Book VI of the Thai Civil and Commercial Code. If a foreigner with assets in Thailand dies without a will, the applicable law may depend on nationality, habitual residence, and connection to Thailand. For example, a foreigner married to a Thai and living in Thailand is treated differently from someone who only visits occasionally.

Make sure your estate is distributed the way you intend (clearly and legally) using our lawyer-drafted Thai–English Last Will (DOCX).

จัดทำพินัยกรรมสองภาษา (ไทย–อังกฤษ) ตามมาตรา 1656: ทำเป็นหนังสือ ลงวันที่ ลงลายมือชื่อต่อหน้าพยาน 2 คน พร้อมคำแนะนำแบบทำเอง (DIY)

Download Will TemplateComplies with Section 1656 (written, dated, signed before two witnesses). Not legal advice.

Status is a useful proxy, but the real drivers are Thai-situs assets, habitual residence, and Thai family ties. Use this guide to decide quickly.

Habitual resident with ongoing Thai assets/family.

Recommendation: Yes — Thai will (often the primary instrument), coordinated with any foreign will.

Spends 3–9+ months/year in Thailand with condo/lease/bank funds.

Recommendation: Usually yes — limited-scope Thai will for Thai assets; still goes through Thai probate but reduces translation/legalization friction.

Living/working in TH; salary/bank/car/condo; Thai family possible.

Recommendation: Yes — Thai will (Thai assets + guardianship where relevant).

Long stays; meaningful Thai assets.

Recommendation: Usually yes — Thai will limited to Thai assets.

Primary residence abroad; minimal Thai ties; foreign-quota condo held as investment possible.

Recommendation: Thai will not recommended. In many projects, a duly legalized/apostilled foreign probate with certified Thai translation can transfer the condo without full Thai probate (subject to Land Office/juristic practice).

No meaningful Thai assets.

Recommendation: No Thai will needed.

| Status | Typical Stay | Thai Assets | Thai Family | Recommendation |

|---|---|---|---|---|

| PR / Thai citizen | Full-time | Yes | Often | Yes — Thai will |

| Non-Imm O / O-A | 3–9+ months/yr | Condo/lease/bank | Usually none | Usually yes (Thai-assets will) |

| Non-Imm B / O (spouse) | Long-term | Salary/vehicle/condo | Often | Yes — Thai will |

| Thailand Elite | Long stays | Likely | Varies | Usually yes |

| Occasional visitor | Short/seasonal | Maybe condo (investment) | No | Not recommended |

| Tourist | Short | No | No | No |

Note: A Thai will still requires Thai court probate (executor/administrator appointment). Procedures can vary by Land Office and condominium juristic person. This is general information, not legal advice.

Secure your legacy: A bilingual Thai–English last will ensures your estate is handled exactly as you intend and avoids legal disputes.

การทำพินัยกรรมในประเทศไทยมีความสำคัญเพื่อให้ทรัพย์สินถูกแบ่งตามความประสงค์ของผู้เสียชีวิต หากไม่มีพินัยกรรม กฎหมายมรดกไทย (ประมวลกฎหมายแพ่งและพาณิชย์ บรรพ 6) จะกำหนดให้ทรัพย์สินตกทอดแก่ทายาทโดยธรรมตามลำดับชั้น ได้แก่ บุตร, บิดามารดา, พี่น้องร่วมบิดามารดา, พี่น้องร่วมบิดาหรือมารดา, ปู่ย่าตายาย, ลุงป้าน้าอา คู่สมรสที่จดทะเบียนจะได้รับส่วนแบ่งตามที่กฎหมายกำหนด แต่คู่ชีวิตที่ไม่ได้จดทะเบียนสมรสไม่มีสิทธิรับมรดกโดยอัตโนมัติ

Guidance by asset, across the A/B/C profiles. A = occasional visitor, B = long-stay with Thai assets, C = habitual resident/Thai family.

| Asset in Thailand | A | B | C | Notes |

|---|---|---|---|---|

| Condo (foreign quota) | Not recommended | Consider | Yes | Foreign probate (legalized + TH translation) can often transfer without full Thai probate; practices vary. |

| Land Lease (up to 30y) | Consider | Yes | Yes | Lease rights administration is smoother with a Thai will naming your executor/heirs. |

| Superficies / House separate from land | Consider | Yes | Yes | Real right attached to property; Thai will clarifies succession/management. |

| Bank accounts / term deposits | Consider | Yes | Yes | Banks commonly require Thai court order; Thai will expedites. |

| Vehicle | Consider (value-based) | Yes | Yes | DLA transfer typically needs Thai probate appointment if owner deceased. |

| Company shares (Thai Co., Ltd.) | Consider | Yes | Yes | Share transfer/registration usually needs Thai court appointment + docs. |

| Personal effects / art / valuables | Optional | Consider | Yes | Practicality depends on value and location (home vs. safe-deposit). |

Note: A Thai will still requires Thai court probate (executor appointment). Land Office & condominium juristic practices can differ. This is general information, not legal advice.

Most differences are practical (registration rules, eligibility, documents), not “can/can’t inherit” in principle. Use this table as a quick guide; local Land Office and institution practice can vary.

| Asset in Thailand | Thai Beneficiary | Foreign Beneficiary | Notes / Pitfalls |

|---|---|---|---|

| Land (Chanote, etc.) | ✅ Can inherit | ⚠️ Generally cannot hold freehold long-term | Foreign heirs typically must dispose within a statutory period if not otherwise eligible to own; consider bequeathing a lease/superficies instead of land freehold. |

| Condominium (freehold, foreign quota) | ✅ Can inherit | ✅/⚠️ Allowed if foreign quota & eligibility conditions are met; otherwise disposal required | Project must have foreign quota available; documentation often includes probate order + certified translations; practices vary by Land Office/juristic person. |

| House / Building (separate from land) | ✅ Can inherit | ✅ Can inherit | Ownership of structure is separate from land; ensure a supporting lease or superficies exists and is transferable/inheritable. |

| Registered Lease (>3 years) | ✅ Continues with clause/co-lessee | ✅ Continues with clause/co-lessee | Continuation typically requires a clear succession/continuation clause or co-lessees; re-registration/notation at Land Office recommended. |

| Usufruct (สิทธิเก็บกิน) | ⛔ Ends on holder’s death | ⛔ Ends on holder’s death | Not inheritable by nature; consider superficies for an inheritable real right. |

| Superficies (สิทธิเหนือพื้นดิน) | ✅ Inheritable if drafted so | ✅ Inheritable if drafted so | Make it inheritable/transferable in the deed; register and keep term/renewal clear. |

| Bank Accounts / Deposits | ✅ With Thai probate order | ✅ With Thai probate order | Banks usually require a Thai court appointment of executor/administrator; foreign heirs need legalized IDs and translations; outbound remittance may need extra docs. |

| Vehicle | ✅ Transferable | ✅ Transferable | Department of Land Transport typically needs the court order + originals; insurance/road-tax continuity to check. |

| Company Shares (Thai Co., Ltd.) | ✅ Transferable | ✅/⚠️ Transferable (check foreign limits) | Update share register & DBD filings; foreign heirs must respect foreign ownership limits and any sectoral rules. |

This is general information, not legal advice. Requirements can vary by court, Land Office, bank, and condominium juristic person.

Make sure your estate is distributed the way you intend (clearly and legally) using our lawyer-drafted Thai–English Last Will (DOCX).

จัดทำพินัยกรรมสองภาษา (ไทย–อังกฤษ) ตามมาตรา 1656: ทำเป็นหนังสือ ลงวันที่ ลงลายมือชื่อต่อหน้าพยาน 2 คน พร้อมคำแนะนำแบบทำเอง (DIY)

Download Will TemplateComplies with Section 1656 (written, dated, signed before two witnesses). Not legal advice.

Under the Inheritance Tax Act, B.E. 2558 (2015), effective since 1 February 2016, Thailand imposes inheritance tax only when the value of assets received from one deceased person exceeds 100 million THB. Below that threshold, there is no tax liability.

Tax rates depend on the heir’s relationship to the deceased:

Filing and payment must occur within 150 days of receiving the inheritance. Late filings may incur penalties or interest.

ชาวต่างชาติที่มีพินัยกรรมในประเทศตนเอง อาจไม่จำเป็นต้องทำพินัยกรรมในประเทศไทย แต่ในบางกรณี เช่น แต่งงานกับคนไทย มีทรัพย์สินในไทย หรือพำนักระยะยาวในไทย การทำพินัยกรรมภาษาไทยสามารถช่วยให้การจัดการมรดกเป็นไปอย่างราบรื่น และควรระบุให้ครอบคลุมเฉพาะทรัพย์สินในประเทศไทยเพื่อหลีกเลี่ยงข้อพิพาทกับพินัยกรรมต่างประเทศ

Foreigners who inherit a condo unit in a condominium in Thailand must still qualify for foreign ownership under Section 19 of the Condominium Act. If they do not qualify, the unit must be sold within one year, or the Land Department can sell it on their behalf.

Apartments not registered under condominium laws are typically held under lease or tenancy rights. These rights usually end upon the tenant’s death, unless specifically structured for inheritance. See our guide to inheritance of leases.

Under the Land Code Act foreigners cannot own land in Thailand and therefore cannot inherit it outright. Any inherited land must be sold within one year, with the Land Department authorized to handle the sale and deduct a 5% fee.

Leases in Thailand are personal contract rights and could be terminate upon the lessee’s death. Inheritance is possible covered by the lease agreement.

If property is held via a Thai company, controlling shares may not automatically pass to heirs. Shares must be transferred at the Ministry of Commerce, and without prior planning, heirs may lose control of the company.

ชาวต่างชาติที่ได้รับมรดกในไทย อาจมีข้อจำกัดทางกฎหมาย เช่น คอนโดมิเนียมต้องมีคุณสมบัติเป็นเจ้าของ, อพาร์ตเมนต์และสัญญาเช่ามักสิ้นสุดเมื่อผู้เช่าเสียชีวิต, ที่ดินต้องขายภายใน 1 ปี, และหุ้นในบริษัทต้องโอนอย่างถูกต้องเพื่อคงสิทธิ์ในทรัพย์สิน การวางแผนล่วงหน้าช่วยป้องกันปัญหาในการจัดการมรดก