Condominium in Thailand

Condominium laws and foreign ownership

Thai land laws prohibit foreigners from owning land but the Condominium Act allows foreigners to own a condo in Thailand. Ownership of an apartment in a condominium includes co-ownership in the common areas such as the land, exterior of building, hallways and stairs, roof, swimming pools. Below some frequent asked questions relating to condominiums in Thailand and foreign ownership.

ARE ALL APARTMENT BUILDINGS REGULATED BY THE CONDOMINIUM ACT?

Thailand has 2 types of apartment building, most are registered and licensed with the land department as condominium, but some, as you sometimes see in the tourist areas, are not registered and licensed as condominium. Apartment buildings not having obtained a condominium license must comply with all building regulations and such but are not governed by Thailand Condominium Acts. The main practical legal difference is the form of ownership, only licensed condominiums offer individual unit ownership and joint ownership of the common areas. Possession of the units in an unlicensed apartment building must be created through a contract structure between the owner of the project and the buyers who can only obtain contractual rights (lease) to use the apartment unit (not unit ownership). Only in a true condominium (licensed under the Thailand Condominium Act) the Land Department has issued individual unit ownership title deeds with ownership registration by the land department (read more...)

HOW ARE CONDOMINIUMS REGULATED?

Condominiums are regulated by 1 - its rules and regulations (internal), and 2 - the Thailand Condominium Act (external). The Condominium Act specifies for example the procedure and requirements to be licensed as a condominium. The internal regulations (bylaws) of a condominium for example regulate how the building is run (e.g that the units cannot be used as a business or company address or matters relating pets). The rules and regulations of the condominium are formed by voting of the unit owners in the condominium general meetings.

HOW ARE CONDOMINIUMS MANAGED

The condominium is managed according to the rules and regulation pursuant to relevant sections of the Condominium Act by voting of the owners (either in person or by proxy).

WHAT ARE THE REQUIREMENTS IN SIZE AND NUMBER OF UNITS IN THE CONDO

The Condominium Act does not specify in any detail the specific requirements necessary in order for it to be identified as a condominium. As long as the building is able to hold ownership separately according to the area, whereby each area consists of private ownership in the property and joint ownership in the common property. There are no specifications outlining height or space requirements, nor are there any specifications outlining the minimum amount of individual units necessary within the building. Technically a condominium can also be a group of attached low rise buildings.

CAN A CONDOMINIUM BUILDING IN THAILAND BE 100% FOREIGN OWNED?

The Thailand condominium act allows foreign ownership within the foreign ownership quota of the condominium. Up to 49% of the total floor area of all apartment units in a condominium combined can be foreign owned. Between April 1999 and April 2004, as a temporary measure and an attempt to reduce the number of empty and newly developed condos for sale, foreigners could under certain restrictions and in specified areas own up to 100 % of the units in one single condominium. This has since been amended back to 49% foreign ownership of the aggregate unit space in a condominium building.

CAN ALL FOREIGN NATIONALS OWN A CONDO UNIT IN THAILAND?

There are no restrictions on nationality and every foreigner who can enter Thailand legally can own a condominium, but every foreigner must personally qualify for ownership under section 19 of the Condominium Act. Generally this means that the purchase price for the condo must have been transferred into Thailand as foreign currency and exchanged into Thai baht by a licensed financial institution inside Thailand.

CAN A THAI COMPANY OWN THE CONDO APARTMENT ON MY BEHALF?

Since the initial 2006 Land Office regulations issued by the Land Department and Ministry of Interior preventing the misuse of Thai nominee shareholders by foreigners and a serie of new regulations this practice in less common. A holding company set up to circumvent foreign ownership restrictions is not allowed under Thai law and as such illegal in its purpose. Even though generally considered illegal this structure is often still pushed to sell the remaining units to foreigners in the Thai side of expensive condos in the tourist resort areas of Thailand.

CAN A FOREIGN COMPANY OWN A CONDO?

Foreign juristic entities (e.g. a BVI company) can register ownership within the 49% foreign ownership quota of a condominium just as any natural foreign person. A minutes of meeting is required approving the purchase, company documents of incorporation must be prepared, notarized, translated and submitted with the land office (all or specific company documents, depending on the local land office requirements), together with documents such as a foreign exchange transaction form, as when a foreign individual is buying a condo in Thailand.

WHAT IS A FET FORM?

FET form means Foreign Exchange Transaction form, previously known (and for some still) as Thor Tor 3 (Thor Tor Saam). An authorized financial institution (bank) inside Thailand dealing with the exchange of foreign currency exceeding 50,000 USD (or an equivalent in any other currency) must under banking regulations prepare a FET-form and report this transaction to the Bank of Thailand. For foreigners buying a condominium an original copy of the FET-form is part of the documents required for registration of ownership at the Land Department (proof of compliance with section 19 of the Condominium Act).

I DO NOT HAVE A FET FORM?

For the exchange of foreign currency in amounts less than 50,000 USD the bank does not need to prepare a FET form and therefore will not issue a FET form copy. In this case foreigners can request from the bank a confirmation letter for the transfer of foreign currency and exchange into Thai baht. This letter contains the same information as the FET form (e.g the transferred amount in foreign currency, the exchanged amount in Thai Baht, the name of money sender, the name of money receiver, the purpose of transferring the money) and can be used as proof of compliance with section 19 of the Condominium Act. This proof must be submitted to the Land Department when registering foreign ownership.

CAN I RENT OUT MY CONDO UNIT?

Unless restricted in the bylaws of the condominium (the adopted rules and regulations of the condo) a foreigner is free to rent out his unit. Only if it is considered operating a business of renting out properties in Thailand the foreign owner would be restricted by the Foreign Business Act and possible the Foreign Employment Act. The received rent is subject to personal income tax in Thailand and over properties put to commercial use or rented out by the owner 'housing and land tax' must be paid.

WHEN I SELL MY CONDO DO I HAVE TO PAY TAXES?

When you sell your condo taxes must be and are paid at the Land Office at the time of transfer. This includes personal income withholding tax. With the land office tax-receipt, sale documents and documents confirming the previous transfer of foreign currency into Thailand, the bank is allowed to transfer the full amount received from the sale of a condominium by a foreigner out of Thailand without any deductions.

WHAT ARE THE TRANSFER TAXES?

There are a variety of taxes and fees involved when transferring a condominium unit in Thailand; transfer fee, stamp duty, withholding tax (personal or corporate) and specific business tax (if applicable). How these costs are split between buyer and seller in a re-sale depend on what is agreed between the buyer and seller and can vary from buyer pays all to seller pays all. When buying in a condominium development the seller (developer) can under consumer protection laws only pass on up to half of the 2% ownership transfer fee to the buyer.

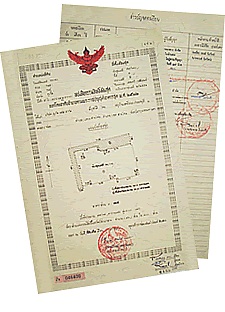

WHAT IS A TITLE DEED?

Each apartment unit in a condominium building has an ownership title deed issued by the Land Department. The title deed must among others contain the following information: 1 - position and location of the land and area of the land of the condominium 2 - position and location, area and plan of the apartment showing the width, length and height 3 - ratio of ownership of common property (ratio of voting rights) 4 - name and surname of the person having the ownership of the apartment 5 - index for the registration of rights and juristic acts 6 - signature, position and seal of the Competent Official. Transfer of ownership of a condominium and amendment on the title deed always takes place at the land department.

CAN OWNERSHIP OF A CONDO BE PASSED ON TO MY CHILDREN?

Any foreigner who receives a condo in Thailand by inheritance or through a gift must separately and individually qualify for ownership under section 19 of the Condominium Act, or he must (section 19 under 7) sell the unit within one year of acquisition by inheritance. Ownership can be passed on to foreign heirs, but generally they cannot register ownership and must dispose of the apartment unit within 1 year.

WHAT IS A HOUSE BOOK IN A CONDOMINIUM?

A house book or blue book or Ta Bien Baan is a residential address registration book issued by the local government municipality. It identifies the exact location of the condominium and apartment address and registers the Thai persons living in it. For foreigners this is not an important document and is less relevant for foreigners as it is just an address registration document, not an ownership document.

BUYING A CONDO PRE-CONSTRUCTION?

When buying a condo off-plan escrow arrangement offers both the seller as the buyer protection. In a pre-construction condominium development in Thailand developers usually require that during the construction payments are made directly into the developer's bank-account and not into a third party escrow account. Payments into the developer's bank account has serious risks and disadvantages for the buyer.

BUYING A CONDO LEASEHOLD?

One of the disadvantages under Thai property laws is that Thailand only knows lease as a personal hire of property contract. Under hire of property laws a condominium leasehold purchaser in Thailand basically becomes a tenant with a prepaid rent. This for example means that a lease is in essence attached to the lessee and the lease is not independently from the condominium owner transferable (it is not an asset). As a tenant the lessee has for example no vote in the joint owners meeting and matters relating to management of the condominium. In addition, a lease contract is under Thai law terminated upon death of the lessee and not automatically transferable to his heirs.

SALE AND PURCHASE AGREEMENT?

The sale and purchase agreement for a condominium specifies in detail the responsibilities of the buyer and seller of the condominium. A sale and purchase agreement covers among others the agreed price and payment schedule, transfer date, exact details of the condominium, responsibilities for transfer fees and taxes, warranties and matters relating to due diligence. A sale and purchase agreement with a developer in a condo development has different requirements compared to a sale contract in a re-sale of an existing condominium, as a developer's sale contract must comply with consumer protection laws. Transfer takes place at the provincial or local Land Department's branche office and at the time of transfer a second official Thai script land office sale agreement is signed. It should be noted that everything at the land office is done in Thai.

SALEABLE FLOOR AREA?

The apartment price in the contract for a not yet completed condominium is based on the size of the condo according to the plans of the building with a price adjustment based on the final size of the unit. Saleable area means the area on which the contract price is based, and registered area, upon which the final price is based, means the exact floor area upon completion of the condo as measured by the Land Department surveyor. The final size of the unit mentioned in the unit title deed could be significantly larger than the size mentioned in the contract which is based on the building plans. A maximum price adjustments should be agreed in the sale and purchase contract for the condo.

WHAT ARE THE COMMON MISTAKES?

- Not having clearly agreed in an off the plan purchase agreement that the purchase concerns a freehold purchase of a condominium registered under the Condominium Act, and not a leasehold purchase;

- Not having transferred foreign currency into Thailand at least equal to the purchase price;

- Not having obtained legal advice on how taxes and transfer fees are to be divided and ending up paying more than necessary;

- Not having obtained legal advice on the condominium sale and purchase agreement required terms and conditions and responsibilities of the parties such as payments in a third party escrow account or directly to the seller;

- Not having conducted due diligence on a project or unit and being confronted with unexpected issues after signing the purchase agreement and having paid the deposit;

- Not having checked the condominium title deed and previous land office sale agreement to ensure that the apartment is free of encumbrances;

- Not dealing with a registered condominium under the Thailand Condominium Act but an unregistered leasehold residential apartment building.

- Not understanding leasehold laws in Thailand and being confronted with pro-landlord laws in Thailand and unexpected responsibilities, costs and taxes as a result of renting a unit.

- Not having read the rules and regulations (or bylaws of the condominium) and not being able to use the unit in a way you planned (e.g. rules which prohibit the use of the unit for any other purpose that residential use and not being able to use it as a business address, or other restrictions)

CONDO FEES

Every condominium must be maintained and managed and for this each owner pays condo fees which are based on the square meters of the each apartment. Condo fees are charged monthy (or 3 monthly or for some yearly) and are each owner's shares in the common expenses and maintenance of the condominium. Condos also have a reserve fund for repairs and upgrades of the building. Condo fees, the size of the reserve fund and possible future major repairs could be an additional financial burden to consider.

CONDO MANAGER AND CONDOMINIUM MEETINGS?

Every condominium shall have at least one manager who is appointed in the general meetings of the joint owners. Learn more anout the responsibilities of the condominium manager, the condominium committee, procedure for meetings and expenses of the condominium in the condominium handbook.

article source: samuiforsale